child tax credit september 2020

Parents of a child who ages out of an age bracket are paid the lesser amount. In most cases a tax credit is.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Have been a US.

. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. Monthly payments will continue through December to amount to half 1800 of the full 3600 per qualifiable child. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000.

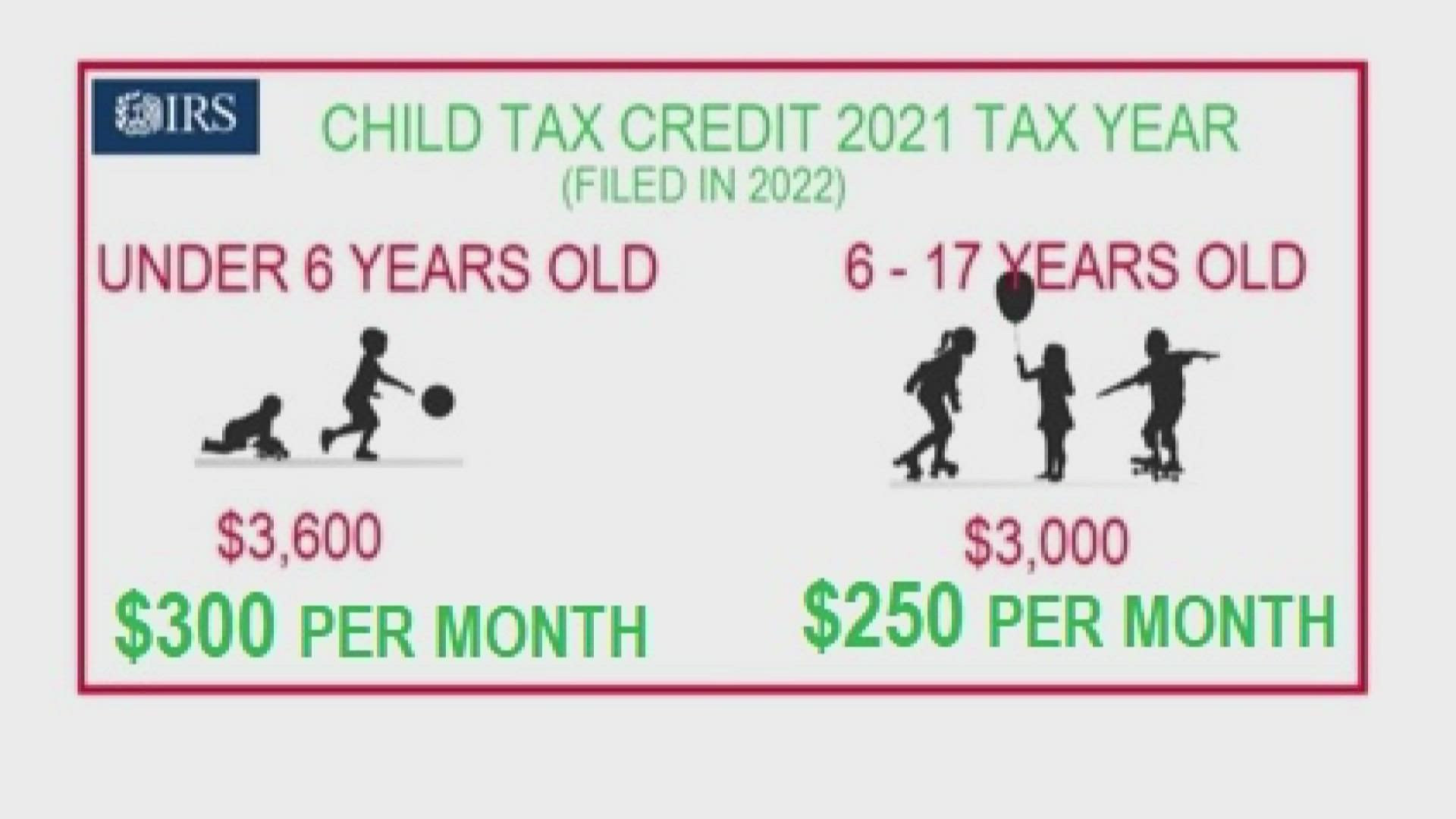

What time the check arrives depends on the. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to. Taking into account the last half of the Child Tax Credit payment which will arrive in 2022 those eligible households will receive a total of up to 3600 per child aged five and.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

Filed a 2019 or 2020 tax return and claimed the Child Tax. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for. The child tax credit CTC will.

Increased to 7200 from 4000 thanks to the American Rescue Plan 3600 for each child under age 6. Without further extensions the Child Tax Credit CTC will return to normal levels in 2022 and can be claimed when filing your tax return next year. It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or 1040-SR line 27.

150000 if married and filing a joint return or if filing as a qualifying. CBS Detroit --The Internal Revenue Service IRS sent out the third round advance Child Tax Credit payments on September 15. The other 1800 will be eligible to be claimed next year during.

The amount you can get depends on how many children youve got and whether youre. Under the American Rescue Plan most eligible families received payments dated July 15 August 13 and September 15. Canada child benefit CCB Includes related provincial and territorial programs.

Receives 3600 in 6 monthly installments of 600. Total Child Tax Credit. Future payments are scheduled for November 15 and.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Making a new claim for Child Tax Credit already claiming Child Tax Credit. What Will be the Amount for the Tax Credit.

Each child in an eligible household under six years-old is entitled 300 per month but its slightly less for any child older than six but under 17 - they will get 250.

Irs Finalizes Updates To Form 941 For Covid 19 Tax Credits Integrity Data

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Axne Led Provisions Included In Final Version Of Covid 19 Relief Deal Advanced To President S Desk Representative Cynthia Axne

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Payment Schedule Here S When To Expect Checks Fox61 Com

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Housing Neighborhood Revitalization Resolutions Of Support For Tax Credit Developments

Irsnews On Twitter Not Sure If You Qualify For Advance Childtaxcredit Payments Check Your Eligibility By Using Our Advance Child Tax Credit Eligibility Assistant Learn More From Irs At Https T Co 9j5hb58rqx Irstaxtip Https T Co Xrcajljyfx

Tax Credits To Help With Employee Related Covid 19 Costs May End Soon Boyer Ritter Llc

Monthly Tax Credit For Children From Irs When Will You Get It Wusa9 Com

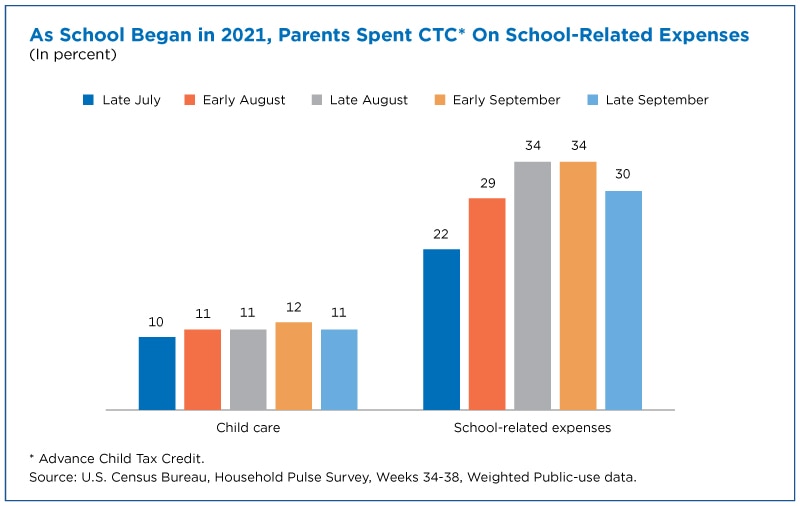

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Wcnc Com

Child Tax Credit Update Third Monthly Payment On September 15 Marca

Child Tax Credits September Payments Go Out Soon Mocamboo Com

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before The Us Sun

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One Fox31 Denver

U S Energy Information Administration Eia Independent Statistics And Analysis